Contact

About the Property Tax

Real Estate/Property Tax bills are typically mailed in late October to early November. The bill has three governmental bodies that receive revenue: City of Paducah, Paducah Junior College, and the City School District. The school district depends upon where you live in the City. Some people live in the City but are in the McCracken County School District.

Note: The City government does NOT set the city or county school tax rates or assess a property's value. Property owners will receive a separate bill from the McCracken County Sheriff for County government and other agencies.

Revenue generated by the property tax is the second highest revenue source for the City of Paducah generating an anticipated $8.57 million for Fiscal Year 2024. Only the payroll tax generates more revenue.

2023-2024 Tax Rates

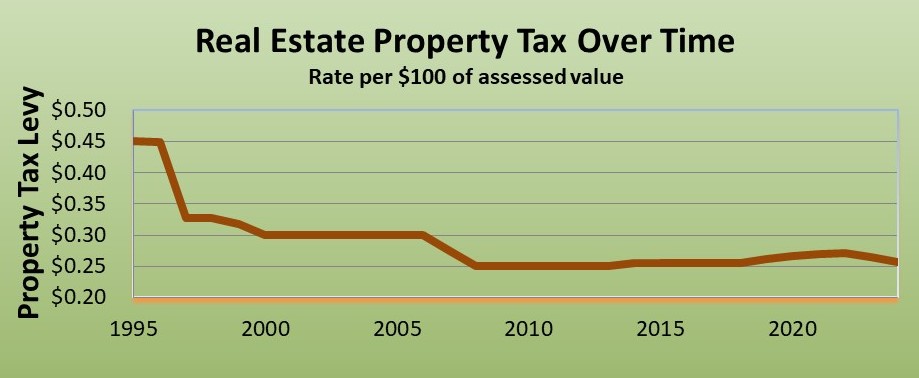

The City's property tax rate for Fiscal Year 2023-2024 is $0.256 which means for every $100 of assessed value of real estate, $0.256 (slightly more than a quarter) is paid to the City of Paducah. For a home that has an assessed value of $50,000, a property owner pays $128.00 to the City of Paducah in property taxes. This rate is LOWER than the 2022-2023 rate of $0.265. The Paducah Board of Commissioners adopted the Fiscal Year 2023-2024 rates at its September 26, 2023, meeting.

How to Calculate Your Property Tax

Payment Options

Payments can be made in-person at City Hall or over the phone at 270-444-8513. Real estate and personal property taxes also have an Online Payment option.

In addition to cash and/or check, the City of Paducah accepts credit and debit card payments. Services payable by credit or debit card include business licenses, property tax bills, building permits, fines, and liens. A 2.95 percent service charge will apply on credit and debit card payments. Payment types include Discover, MasterCard, and Visa. The City does not charge or retain this service charge. There is a $2.00 minimum per transaction.

Due Dates

The due dates for the real estate/property tax bills are outlined in Chapter 106 of the Paducah Code of Ordinances. Property taxes levied herein shall be due and payable in the following manner:

- In the case of tax bills which reflect an amount due of less than $2000.00, the payment shall be due on November 1 and shall be payable without penalty and interest until November 30.

- In the case of all other tax bills, payment shall be in accordance with the following provisions:

- The first half payment shall be due on November 1 of the tax year and shall be payable without penalty and interest until November 30.

- The second half payment shall be due on February 1 of the following year and shall be payable without penalty and interest until February 28.

Frequently Asked Questions

- Who determines the value of my property?

-

The McCracken County Property Valuation Administrator (PVA) is responsible for setting property assessment valuations for property tax purposes. The PVA can be reached by contacting Property Valuation Administrator Bill Dunn at 270-444-4712 or by visiting the PVA Website.

- How has the City of Paducah’s property tax rate changed in the past 25+ years?

-

Back in 1995, the tax rate was slightly more than 45 cents per $100 assessed value. That made up about 41% of the tax bill. But with the conscious effort over the past several decades to get it down to the current rate, our portion of the tax bill is now less than a quarter.

- How does property tax rank with other City revenue sources?

-

Property Taxes generate more than $8 million each year. It is the City's second largest revenue source with payroll tax as the City's number one source.

- What are the other entities on the property tax bill?

-

According to Kentucky Revised Statutes, we must collect the tax for the Paducah Independent School District. However, the school board sets the tax rate. We simply pass the funds along to them. We also collect the tax for Paducah Junior College, Inc. which is associated with West Kentucky Community & Technical College. So we collect for three entities but keep only a small portion of the total bill.

- If my house is assessed at exactly the same value as my neighbor’s house, is it possible to have a different amount on my tax bill?

-

Yes, it is possible since it depends on which school district you live. Most of the western end of Paducah is in the McCracken County School District. That means on the border between the two districts, houses across the street from each other could be in different districts.

There are fewer households in the City that are in the County school district; however, the households that are in the County school district make up more than half of the total assessed values for properties within the city limits.

Property Tax Rate History

- For the City's real estate property tax levy history since 1995, visit Real Estate.

- For the City's personal property tax levy history since 1995, visit Personal Property Tax.

- For the Inventory Property Tax History since 1995 for the Paducah Independent School District, visit Inventory Property Tax. The City of Paducah discontinued the Inventory Property Tax in 2003.

To learn more about the City's property tax rate, its history, and how it compares to other Kentucky cities, watch this Paducah View episode featuring Finance Director Jonathan Perkins (January 2014, 6:20 minutes).